General questions

Your advantages over other traders who do not have this terminal:

- The tick chart (a second chart on which each trade is visible).

- Monitor all exchange coins across all pairs and quickly spot a good move.

- Unlimited order size (the Free version limits order size to $40).

- Unlimited number of active orders (the Free version is limited to 20 orders).

- Quickly place both single orders and a grid of indented orders in a single click.

- The ability to receive signals from private channels and Telegram groups and automatically place orders and buy coins, with simultaneous setting of take, stop losses and trailing.

- Ability to trade to all existing pairs on the exchange.

- Ability to use unique manual and automatic strategies.

- A large number of filters and advanced stop setting.

- Dynamic vertical and horizontal volumes.

- Online chart drawing functionality (support lines, slopes, fibo, etc.)

- Ability to place sell orders on coins held on balance and purchased on the exchange manually.

- Saving graphs of all coins after restarting/exiting and restarting (if no more than 8 hours have passed between bot starts).

- Spot and futures trading with the possibility to connect additional modules extending the terminal's capabilities ("Moon Scalper", "Binance Futures").

- Free connection of other API keys from the same exchange account with PRO status.

- The ability to run an unlimited number of copies of the bot (the Free version is limited to 1 active bot).

- Possibility to use UDP Trusted Control (in Free version Trusted Control is only possible in emulation mode).

- Instant retrieval of commands from TradingView by means of a web hook.

And many other features.

1) in English: https://moon-bot.com/en/home/

2) in Russian: https://moon-bot.com/ru/home/

After clicking this button the archive will be downloaded to your computer, which should be extracted into a separate folder on your computer, e.g. C:/Moonbot.

The MoonBot terminal is a portable x64 Windows application designed to automate cryptocurrency exchange trading. The current version supports Binance, HTX and Bittrex exchanges.

You can find all the benefits of the PRO version on our website "PRO version" page https://moon-bot.com/en/pro-version/

Operating system: Windows 7 64bit/ Windows server 2012 (64 bit) or older, but always with a 64 bit architecture.

When installing the MoonBot terminal on a dedicated server (VDS), choose a configuration with 2 vCores CPU and 2GB RAM.

1) Download the MoonBot terminal archive from our website https://moon-bot.com/files/MoonBot.zip

2) Unzip it into a separate folder (not in the system folders or on the desktop).

Attention, recommendations for installation and location of the MoonBot folder:

a) Do not run the MoonBot terminal from the archive;

b) Do not extract MoonBot to the desktop, temporary and system folders in your operating system, such as windows, temp, users and so on;

c) Do not use Cyrillic letters in the folder names in the path to the MoonBot terminal;

d) If your computer has drives other than the system C drive, such as D, E, etc., then place the MoonBot terminal folder on them. If the computer only has a system C drive, then place the MoonBot folder on this drive in a separate folder in the root directory, e.g. C:\MoonBot.

3) To run the MoonBot terminal you need to right-click on the MoonBot.exe file and select "Run as administrator", this mode will increase the priority of the application on your PC, the clock accuracy will be normalised and the connection to the exchange will be improved.

4) On the Settings - Login tab you need to select the desired exchange and enter the API keys from that exchange's account into the relevant fields below and click on the "Register API keys" button. You do not need to re-enter API keys when you run MoonBot next time.

Important: Be sure to make backups of the folder with the MoonBot terminal after registering the API keys!

A backup is the only way to restore keys in case of disk formatting and system reinstallation.

5) When using the MoonBot terminal on a VPS (remote server), select Menu - System Settings in the bot and check "VDS optimized mode" in the window that appears, then reboot the bot in administrator mode.

6) Ensure that the Start button, which is located in the top left corner of the MoonBot main terminal window, is pressed.

7) Adjust the basic parameters and strategies to suit your trading style.

For more detailed instructions on installing and running the application, see Installation and API Keys at https://moon-bot.com/en/manual/api-keys/

- The volume of each buy order on the FREE version is limited to 40 USDT BTC equivalent.

- You can only run one FREE bot on a computer.

- Trading on FREE version is only possible on BTC pairs, other pairs can be viewed in the bot, but orders cannot be placed (trading on all pairs is only available on PRO version)

- Trading on the FREE version is only possible on the spot market (futures trading is only possible on the PRO version with the additional Binance Futures trading module activated).

The benefits of the PRO version are described here: https://moon-bot.com/en/pro-version/

MoonBot terminal download page: https://moon-bot.com/en/download/

MoonBot terminal installation and start-up: https://moon-bot.com/en/manual/api-keys/

MoonBot user trade statistics (real time / 24 hours / weekly): https://stat.moon-bot.com/

After reading the information on the website, the following steps need to be taken:

1) Register an account on the Binance exchange using one of the four corporate referral links to activate the exchange's partial rebate bonus program and activate additional functionality in MoonBot. A list of bonus program representatives can be viewed by clicking on the MoonBonus button at the top of the main MoonBot terminal window.

2) Register trading API keys on the Binance exchange (enable trading permission and whitelist the IPs to be traded from, if necessary).

3) Make a trading deposit, but not less than the minimum lot on coins (from $15 in BTC equivalent for FREE version).

4) Download the MoonBot terminal from the official website https://moon-bot.com/en/download/

5) Launch the MoonBot terminal on your computer in administrator mode.

6) Register the previously obtained API keys in the MoonBot terminal https://moon-bot.com/en/manual/api-keys/

7) Set up strategies (manual and automatic) https://moon-bot.com/en/manual/strategies/

8) Begin test trading and mastering the Moonbot functionality.

Contest rules:

1) The competition starts on the 1st and 3rd Mondays of each month, at 00:01 GMT+0, and runs for exactly one week.

2) Only users of the free FREE version of the MoonBot terminal can participate and all trading methods are allowed - manual, auto by strategy, by signal, etc.

3) A current version of the MoonBot terminal is required, with a valid Telegram handle to contact you.

4) The top three winners are selected on the basis of the largest weekly profits in USD, whereas the minimum number of orders must be at least 50 and the minimum profit at least 20 USD.

Prizes:

1 place: 1 month activation of MoonBot PRO + Moon Scalper + Binance Futures and 2 weeks access to the MoonBot Academy English closed group

2 place: 2 weeks access to the MoonBot Academy English closed group

3 place: 1 weeks access to the MoonBot Academy English closed group

Read more about the conditions of the competition on this page of our website: https://moon-bot.com/en/91-competitions/

Or you can set a permanent attribute on the MoonBot.exe file to run it as an administrator. To do this, select the MoonBot.exe, right-click on it, select Properties - Compatibility - check the "Run this program as аdministrator" box - Apply - OK. In this case you can now run the bot by simply double- clicking on the MoonBot.exe file and it will run in Administrator mode automatically.

Running the MoonBot terminal in administrator mode allows it to take priority over the main processes on the computer, as well as improving clock synchronisation and accuracy in the MoonBot to prevent the effect of the main price line and tick-trading on the chart being stratified. Clock accuracy is considered normal if it is in the plus or minus 50 ms range. If you see a red "Clock accuracy Bad" message in the bottom left corner of the MoonBot main window, you should take the necessary steps to correct this situation (restart your computer, router, check your Internet connection, check your time sync and time zone, and then restart MoonBot in Administrator mode).

Attention, recommendations for installation and location of the MoonBot folder:

a) Do not run the MoonBot terminal from the archive;

b) Do not extract MoonBot to the desktop, temporary and system folders in your operating system, such as windows, temp, users and so on;

c) Do not use Cyrillic letters in the folder names in the path to the MoonBot terminal;

d) If your computer has drives other than the system C drive, such as D, E, etc., then place the MoonBot terminal folder on them. If the computer only has a system C drive, then place the MoonBot folder on this drive in a separate folder in the root directory, e.g. C:\MoonBot.

After activating this module, features such as

- Vertical volumes

- Horizontal volumes

- Drawing functionality on the graph

- Ability to activate smooth schedule mode

- Placing multi orders

- Alerts on drawing elements

Read more about the functionality of the Moon Scalper module here: https://moon-bot.com/en/pro-version/moon-scalper-addon/

The drawing functionality of the chart can be configured by right-clicking on the Pencil button (Draw on the chart).

In this menu you must select and click on one of the items:

- Pen (free drawing)

- Horizontal line (level with price)

- Sloping line (trend line)

- Triangle (triangular zones)

- Fibonacci lines (the 0.618 level is user-defined, you can drag this line with the left mouse button while holding down the Ctrl button)

- Rectangular area (price level or percentage level)

You can also choose line colour, thickness, type and transparency.

In order to start drawing, hold down the Ctrl button on the graph and hold down the left mouse button to draw the required element.

To remove an element, press Ctrl+Z or move the mouse cursor to the selected element, press the left mouse button and select "Remove" from the menu. If you want to change the position of the drawn element, hold Ctrl and move the cursor over the outermost point or line of the element and edit its position.

If you need to disable all drawings on the graph urgently, press the Pencil button (the button will become inactive) to disable the drawing layer.

What is the Binance Futures module in the MoonBot terminal for and is there a free testing period?

In addition, this module gives you the opportunity to trade Quarterly Futures Contracts as well. You connect to futures trading on the Settings - Login tab.

You can purchase the optional Binance Futures module from the Settings - Unlock tab of the MoonBot terminal.

There for owners of the PRO version is available free testing of the module for 7 days with the limitation of the order size to $30 without taking into account the leverage, that is, the order size with the selected leverage during the test period can be from $30 to $3750.

- Activate a futures account on the Binance website.

- Transfer some funds to the futures account.

- Obtain new API keys on the Binance exchange with permission to trade in futures (when creating the keys, you need to edit the permissions and check the box allowing to trade in the futures market), and if necessary, prescribe a white IP address in them.

- Copy the current folder with the MoonBot terminal for spot trading to create a separate MoonBot terminal for futures trading.

- Next, you need to open the tab "Settings - Login" in your copy of the MoonBot, select "Binance Futures" from the drop-down menu and click the "Apply" button.

- Then click on "Register another keys" and enter the new API keys that have permission for futures trading.

- Then click "Register API keys" and wait for the MoonBot to load futures mode.

If you are having difficulty connecting the MoonBot terminal to futures trading, the following information on our website is useful:

https://moon-bot.com/en/manual/api-keys/

https://moon-bot.com/en/pro-version/binance-futures-addon/

You can also ask for help in the Moon Bot Public telegram group: https://t.me/Moon_Bot_Public

- Spread strategy

- EMA filter

- EMA strategy

- Additional parameters in the MoonShot strategy for setup of repeated triggers

- Set of parameters for managing triggers

- Set of options for Session Management

The expansion pack for Autotrading is activated in the "Moon Credits" window for internal MoonBot credits.

Without activation, the features in this package operate only in Emulator mode, enabled through the Menu on the MoonBot main terminal window.

To open the "Moon Credits" window, click on the PRO Version inscription in the lower right corner of the main Moonbot window or on the "Moon Credits" inscription on the "Settings - Unlock" tab.

The available amount of Moon Credits on your balance can be viewed in the same window at the bottom left.

You can refill your Moon Credits balance through our administrators by requesting them in the official MoonBot terminal telegram channel: https://t.me/Moon_Bot_Public

The data folder in this zip must be copied into the folder of the MoonBot terminal with replacement.

Attention! This operation should be done with the terminal turned off and it will completely replace all the strategies that were previously in it!

If you already had your filled strategies, make a backup of the data folder before copying.

You can select the types of strategies you want and adjust them to your trading ideas, with numerous parameters in the strategies that can be changed with varying degrees of precision and in varying ranges.

The MoonBot itself does not check the "adequacy" of the parameters and will execute a strategy according to the settings you have specified, so please read the descriptions of the strategies and their parameters carefully and only activate strategies if you are sure about what you are doing.

You can always pre-test strategies in the "Emulation mode", in order to verify the basic settings (detects, filter settings, location of Buy and Sell orders, EMA and trigger settings, stops, trailing stops and other settings), but these will not be as accurate as real account strategies, as the emulator will not account for pings and lags, as well as the fill rate and the real drawdown of orders. That is why a strategy that has been working in the "Emulation mode" for a long time and showing positive results on a real account with a working order can work with zero profit as well as with a negative one.

We recommend you to use the real trading mode with minimal order to test strategies on a long distance with real trades.

If you are satisfied with the strategy's performance, you can then gradually increase the order size and monitor the reports.

Information on strategies and their parameters can be found on our website: https://moon-bot.com/ru/manual/strategies/

Go to Settings - Advanced - System, activate the Extended Debug Mode (check the Extended Debug Mode box), then open any chart and a few lines will appear on the top left with all the data for that coin and look at the actual strategy values - this is the only way to see what is really happening. No one can tell you more just by looking at the screenshot - it's a matter of mathematics and actual values.

If you find it difficult to set up strategies, you can get paid expert advice in a private MoonBot Academy English paid Telegram group (contact Kost Main https://t.me/kostmain for access to this group).

You can also ask for help in the Moon Bot Public telegram group: https://t.me/Moon_Bot_Public or you can get paid expert advice in a private MoonBot Academy English paid Telegram group (contact Kost Main https://t.me/kostmain for access to this group).

Drop Detection, Wall Detection, Pump Detection, MoonShot, Volumes Lite, Volumes, Waves, Delta, UDP, MoonStrike, NewListing, Combo, TopMarket, Manual, Liquidations, EMA, Spread, MoonHook, Activity.

You can read more about these strategies on our website: https://moon-bot.com/en/manual/strategies/

To read the logs see the video workshop from MoonAcademy at this link:

https://www.youtube.com/watch?v=rF6x61f1Ks4#t=17m40s

This video is in Russian, but you can include subtitles translated into English.

API Key is a public key, which is used to register your MoonBot terminal.

API Secret is a private key that is used to sign orders.

The first time you start the MoonBot terminal, you need to enter the API Key and API Secret keys in the corresponding fields on the Settings-Login tab.

API keys are stored on your computer locally in the root folder of the MoonBot terminal in encrypted form in the file BotConfig.bcfg, which is automatically created by the terminal.

The API Secret private key is not transmitted to the Internet!

For additional protection of your API keys, you can set a password in the MoonBot terminal, and this password will be asked each time the program is launched.

The password is also used only locally on your computer.

on the website of the exchange on which you are trading.

When trading futures, there is another important circumstance: 2 MoonBot terminals operating independently on the same coin may cumulatively exceed the position limit, resulting in an inability to place a close order.

If you do run several bots on 1 account (at your own risk), be sure to use different size orders on them. When working with the same orders the probability of failure and loss of an order is much higher!

management, you can also install Parallels on a Mac.

This is mainly due to several reasons, here are some of them:

1) Problems with your hardware (computer, router).

2) At this time, your computer could be in hibernation mode and not receive data on trades.

3) Problems with your ISP and internet.

4) Problems and lags on the exchange.

reasons.

If you are trading on a dedicated server (VDS) there is not much to gain by using the Moon Streamer, the Moon Streamer is mainly useful if you are trading on your local computer.

1) Reboot your computer and MoonBot in administrator mode

2) Reboot the router and check the stability of the Internet connection. If possible, do not use Wi-Fi, but use wired internet.

3) Disable the computer sleep mode, when the charts do not receive data from the exchange

4) Use modules "Load Charts" (on the Settings - User Interface tab, check Charts from MoonServer or update them periodically manually as breaks occur, using in this case on Menu tab select "Reload Charts" or on Hotkeys tab combination written in field "Reload Chart") and "Moon Streamer".

5) If this is a temporary lag exchange or provider, then you need to contact their technical support or wait for the situation to stabilize.

If it is something completely abnormal, you should download a new MoonBot from the site and check the situation on it under the same conditions.

If the problem disappears, you can then transfer all the old files with settings and data from the old bot to the new one, and then check again the disappearance of cross trades.

https://t.me/Moon_Bot_Public

Moon Bot Public Telegram Group (general questions and technical support)

https://t.me/MoonBotNews

MoonBotNews Telegram Channel (important news and versions of MoonBot updates)

https://t.me/MoonBot_Profit

MoonBot Profit Telegram Channel (examples of profits from MoonBot users)

Then make a copy of the MoonBot terminal folder and delete the entire logs folder from it, it can weigh a lot and moving the copy to another server can take a long time.

To make the MoonBot folder even lighter, you can delete files with charts like: "BTC-MarketData.zip", then compress the folder with the bot: right-click on the folder, select "Send" -> "Compressed ZIP folder" in the menu, then move this ZIP folder to a new server and uncompress it into a normal folder.

You can then run MoonBot.exe in administrator mode on the new server.

The first method:

- Close both MoonBot terminals.

- Open the data folders of both terminals.

- Copy the data / Binance Futures-USDT-strat.txt strategy file from the USDT futures terminal, paste it into the USDT spot terminal folder and rename it to Binance-USDT-strat.txt.

- Run the MoonBot spot USDT terminal in administrator mode, click on the Strategies button and make sure the copied strategies are present in the strategies window.

The second method:

- Without closing both MoonBot terminals, select the strategies or strategy folders you want in the USDT futures terminal by holding down CTRL and clicking on them one by one or by holding down SHIFT and clicking from first to last.

- Then press CTRL+C and copy all selections to the clipboard.

- Then, in the spot USDT terminal, click on the Root folder, press CTRL+V and paste the contents from the buffer.

- Make sure that all strategies appear in the MoonBot USDT spot terminal.

Drop Detection, Wall Detection, Pump Detection, MoonShot, Volumes Lite, Volumes, Waves, Delta, UDP, MoonStrike, NewListing, Combo, TopMarket, Manual, Liquidations, EMA, Spread, MoonHook, Activity.

Every trader develops the strategies according to his trading style and risk management.

Each of these strategies when set up correctly (filters, detects and other parameters) can improve trading and make profit.

One of the oldest and safest strategies is MoonShot, which places limit orders in the green box, follows the price at a certain distance and triggers a sharp price break, as well as other popular strategies: Drops, Pump and Spread.

The statistics of popular strategies can be found on our website: https://stat.moon-bot.com/ (Strategy Ratings tab).

- MoonBot1 for BTC pair

- MoonBot2 for USDT pair

- MoonBot3 for BNB pair

- MoonBot4 for the BUSD pair

This is done so that each of bots will monitor its market and open charts of the most volatile coins or identify sharp shoots or strong spills. As soon as such movements start, you can act according to the situation, connect auto-strategies or trade manually.

For convenience, the detections of each bot can be redirected to separate windows (charts), in which they will stay for a given time and you can monitor them in a more convenient format.

You can read more about the functionality of the monitoring windows on this page: https://moon-bot.com/en/charts-in-separate-windows/

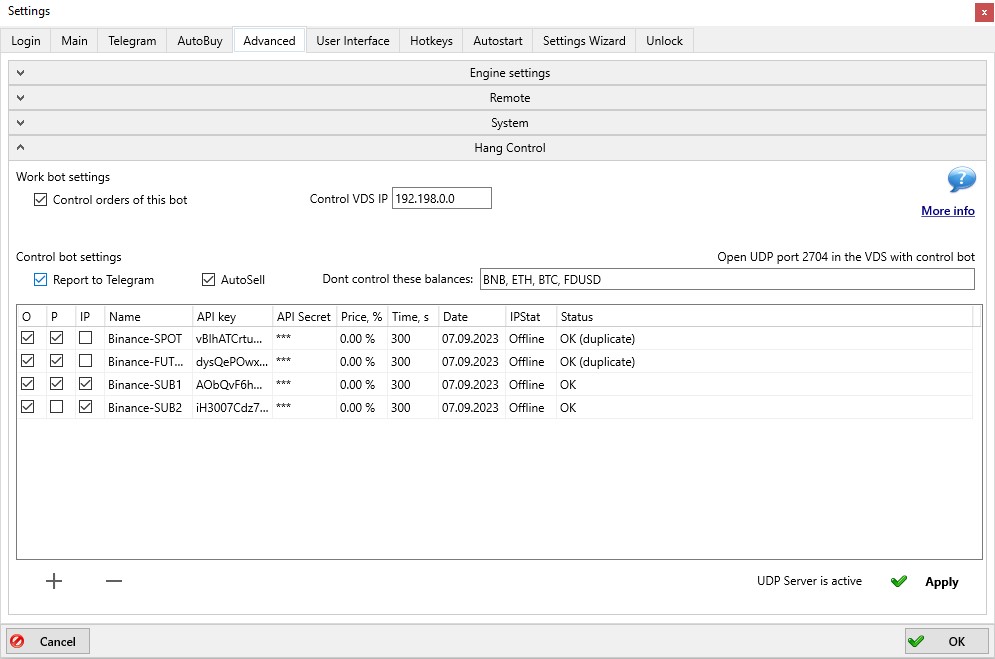

In MoonBot, this can be done by controlling signals via Telegram (with a slight delay of 1-2 seconds) or via UPD (faster transfer of commands).

How it works: The MoonBot terminal can automatically generate commands corresponding to basic trading actions: place, reorder, sell, cancel an order. The commands are either sent to your personal channel in a special form or via UPD protocol and these signals can be read by other terminals. Thus, your terminal can be the master and the terminals of other users you have invited to the trust management can be slaves and they will repeat your actions.

The function of receiving commands is only available in the PRO version!

Please note that exact repetition is not possible due to the speed of the commands and the queue in the trading stack!

For more information on setting up trust-management via telegram, see this page: https://moon-bot.com/en/74-trust-management/

For more information on setting up UPD trust management, see this page: https://moon-bot.com/en/86-udp-trust-management/

https://t.me/MoonBotNews

You can click on this tab and update the MoonBot terminal to the latest version. In addition, new version announcements and version history are published in the MoonBotNews channel at https://t.me/MoonBotNews, as well as on our website under: Instruction-History versions of https://moon-bot.com/en/manual/versions-history/

If you cancel an market stop on the MoonBot terminal chart, then the coin position will be cancelled and the unsold coins will remain on your balance.

Note that in order to be able to use a market stop, you should also set the slider to the far right on the Settings-Advanced-System tab to "Log level: 5".

Can I use the “+” symbol in my mailbox name when registering sub-accounts in the MoonBot terminal?

Is order and position control functionality available on the Free version of the MoonBot terminal?

The function of tracking hovering positions does not work for Bittrex exchange, as there is no such functionality in the API of Bittrex exchange and therefore it is impossible to set a tracking bot for this exchange. Attention! The Bittrex exchange has ceased trading activity since 04.12.2023 due to its bankruptcy, so its support in the MoonBot terminal is no longer available.

Training

There are also many free videos on these topics on our website (https://moon-bot.com/en/video/) and on YouTube (https://www.youtube.com/@moonbot_en/videos).

But some users require professional help for a fee from a specialist who can answer all their questions online, help to explain the algorithms of strategies, help to understand and explain errors in MoonBot terminal and strategies settings.

Such professional help is provided in a private MoonBot Academy English paid Telegram group. To find out the cost of participation in this group and ask more specific questions, you can contact Kost Main https://t.me/kostmain

https://moon-bot.com/en/pro-version/

https://moon-bot.com/en/manual/api-keys/

https://moon-bot.com/en/pro-version/moon-scalper-addon/

https://moon-bot.com/en/pro-version/binance-futures-addon/

and others.

There are also video clips on a separate page on our website: https://moon-bot.com/en/video/

If you don't have enough information or have further questions, you can get free help in the Moon Bot Public telegram group https://t.me/Moon_Bot_Public or paid help in the MoonBot Academy English group, which you can access by contacting Kost Main https://t.me/kostmain

https://www.youtube.com/@moonbot_en/videos

You can also find other videos from our users on YouTube using the search term "MoonBot".

Bonus programme

1) https://t.me/ButchWhite

2) https://t.me/krypto_pride

3) https://t.me/mnbtuser

4) https://t.me/CryptoTonyESBC

File system

Ensure that the BotConfig.bcfg file is properly secured. Make a copy of this file on a USB flash drive and store it in a safe place.

The person in possession of this file and its password will have access to your keys!

There are text files without prefix ADD with date (year-month-day) with extension .log - it is a log of all bot actions for those dates in which bot records all events line by line with time: bot start and stop, strategy start, buy, sell, order reset, API errors, records of stop losses, trailing as well as other working and system events.

There are text files with prefix ADD with date (year-month-day) with extension .log - these are logs of all records from Telegram for these dates, which were received by MoonBot, and you can determine if the terminal reads messages from Telegram correctly.

Also in the logs folder there are Pump files with an indication of a trading pair and with the .bin extension are graphical records of trades in the MoonBot terminal. You can open them through the table with reports if you click on the name of the coin in the line with the report and see what deal was entered and how it closed, you can change the duration of these deals' chart records in the MoonBot terminal settings.

The files BinanceBTCOrders.backup2 and BinanceBTCOrders.backup3 are copies of the main file BinanceBTCOrders.backup and if it is accidentally corrupted, the bot takes data from these files with index 2 and 3.

If you delete these three files when the bot is closed, the next time you start the bot, these files will be re-created by the bot as empty and all orders on the chart will be missing.

Specifying the name of the trading pair in the file corresponds to the orders on this pair, if you trade on the USDT pair, the bot creates files BinanceUSDTOrders.backup, BinanceUSDTOrders.backup2 and BinanceUSDTOrders.backup3.

Strategies can be transferred to another pair, to do this, copy the file with the strategies and change the name of the trading pair, and after running the bot, check the strategy for compliance with the parameters of this pair (the volume in the filters, the order size, etc.), since the strategy BTC order size can be set to 1 BTC, but in the strategy USDT it will be 1 USDT, then you need to change the order size to the size you need in USDT.

the pair of which was open at the time this icon was pressed.

If you use API keys that support white IP addresses, it is recommended to use permanent IP addresses. In this case you will be protected from such errors. In your case, in spot trading, if orders are not saved in the bot, you can use a backup from the bak folder of files like:

bak/BinanceUSDTOrders.backup-1

bak/BinanceUSDTOrders.backup-2

bak/BinanceUSDTOrders.backup-3

Files with orders with digits at the end 1, 2, 3 are written to the bak folder once every 8 hours with a recording coverage of 24 hours.

To restore an order file you need to close the MoonBot terminal, delete "empty" order files from the data folder (for example, for spot trading on USDT pair like BinanceUSDTOrders.backup, BinanceUSDTOrders.backup2, BinanceUSDTOrders. backup3) copy the appropriate file (either the most recent by date or, if the most recent one does not contain orders, the previous one, you can estimate the backup by the file size, the size of an empty file is 32 bytes) from the bak folder to the data folder and rename them according to the format of similar files in the data folder, for example:

bak\BinanceUSDTOrders.backup-1 -> data\BinanceUSDTOrders.backup

After replacing and renaming the orders file, start MoonBot terminal in administrator mode.

In addition, we recommend that you periodically save the MoonBot terminal folder to a separate archive folder at regular intervals so that you can restore data (report files, open trades, strategies, etc.) from this archive.

Reports on all transactions (open, closed, deleted) in the MoonBot terminal are stored in the data folder, in files like: Binance.db (for the spot market) or Binance Futures.db (for the futures market). In rare cases, if MoonBot terminal is closed unexpectedly, the file with reports may be empty. To restore it, you need to close the MoonBot terminal, then copy the backup of the reports file from the bak folder and the data folder and start MoonBot in administrator mode. In addition, we recommend that you periodically save the MoonBot terminal folder to a separate archive folder at a certain interval so that you can restore the data (report files, open trades, strategies, etc.) from this archive.

Can I reduce the InternalError penalty value in MoonBot terminal and make it less than 30 seconds?

When the MoonBot terminal is turned off, you can add a line to the MoonBot.ini file with a new parameter HookRecalcInterval, whose value can be from 200 to 500 (measured in milliseconds) - this is the detector recalculation interval. By default HookRecalcInterval=500 milliseconds). This value affects the detection recalculation rate of the following strategies: MoonHook, Spread, EMA, Activity.

If your MoonBot terminal is located on a remote server without an explorer (core windows), then when you export reports in .csv and .xls format, they are saved to the terminal's Export folder without a file selection window.

Interface configuration

Window with active orders. A window with logs. Field with additional technical information.

The API Key is a public key and is used to register the MoonBot terminal.

API Secret is a private key used to sign orders. The private key is stored locally on your computer in encrypted form in the file BotConfig.bcfg, which MoonBot creates automatically. The private key is not transferred to the Internet!

To register API keys in the MoonBot terminal you need to go to the Settings - Login tab and from the "Exchange:" menu select the exchange you want to trade, for example, if it is "Binance (spot market)", then select "Binance" and click Apply.

Enter the API Key in the "API Key" field.

Enter the API Secret private key in the "API Secret" field. And then click the "Register API keys" button.

If the keys are entered correctly, MoonBot will connect to the exchange server, your MoonBot ID will be displayed in the settings window and the main window will show "Connection OK" in the lower left corner. You do not need to re-enter the keys on subsequent runs of the bot.

Step-by-step instructions for creating and registering API keys are published on our website here: https://moon-bot.com/en/manual/api-keys/

NOTE: Once the keys have been created, the permissions for the API must be edited, in particular the checkboxes permitting spot and futures trading must be ticked and then the changes must be saved, otherwise the placing of orders will not be possible.

IMPORTANT: It is also necessary to select "Allow access only to trusted IP addresses" and specify the addresses where the bots will work with these keys. If this is not done, the permission for spot and margin trading will only be valid for 90 days, after which you will need to re-edit the key restrictions and check the "Enable spot and margin trading" box.

If you plan to run MoonBot terminals for different exchanges at the same time; you can register keys in the same MoonBot terminal without copying it, and switch between exchanges using the exchange selection drop-down list. However, it is better to make a copy of the MoonBot terminal, select a different exchange there and register API keys from the other exchange.

PRO version owners can create multiple API keys in their exchanger account and register them in the PRO version for free. To do this you must:

1) Copy the PRO version of the MoonBot terminal to a separate folder.

2) Run MoonBot from this folder in administrator mode.

3) Make sure you have a working PRO version of the MoonBot running and that your MoonBot ID is green in the Settings-Login tab in the top left corner.

4) There, on the Settings - Login tab, click on "Register another keys", enter the new API keys instead of the current ones and click on "Register API keys". Be careful not to leave any characters from the previous keys in the fields and when copying the new ones, do not trap a space at the end.

5) After this MoonBot with the new keys will also become the PRO version.

Similarly, if it says "Moon Bot Binance Futures", this would mean that the terminal is connected to trade on the futures market of the Binance exchange.

The version number in the MoonBot terminal allows you to always check the history of updates on https://moon-bot.com/en/manual/versions-history/, and check if your version is up to date.

Be sure to use the most current version of the MoonBot terminal, in which case you will not only receive updates, but also fixes for bugs in previous versions.

You can click on this tab manually, the bot will then start updating and after a short time will install the latest up-to-date version.

Once the bot has been updated, the browser will open with the version histories page https://moon-bot.com/en/manual/versions-history/, where you can read what updates and fixes have been made to the new version of the MoonBot terminal.

The MoonBot terminal can be set to update automatically if you check the "AutoUpdate the bot" box in the Settings - Autostart tab, but keep in mind that the bot may update itself at the most inappropriate moment, for example when the BTC is falling heavily, and instead of an urgent close of your positions you will waste precious moments waiting for the terminal to update.

It is therefore recommended that with the "AutoUpdate the bot" checkbox, you also check the "Postpone AutoUpdate with active sells" checkbox, in which case MoonBot will not update while there are open positions.

Alternatively, you can uncheck these boxes and update manually and at your convenience when a new version becomes available.

If you use BTC to trade, the balance must be topped up in BTC, if in USDT, the balance must be topped up or converted to USDT and so on. If you have transferred money to the exchange, but the balance does not appear in the bot, then carefully check where the money is at the moment, maybe it remained lying in the top-up wallet (p2p) and therefore is not displayed in the trading balance account. In this case, to make the deposit appear in the terminal, you need to transfer funds from the top-up wallet to the spot or futures trading balance and in the currency you intend to trade with.

That is, if you expand the chart, the lows and highs will shift, and the scale will also change dynamically to accommodate them. This mode is used when you want to quickly adjust the scale depending on volatility.

Sometimes it can happen that a coin will suddenly start to plummet, and then, in Autoscale mode, the chart quickly adjusts to the maximum price swing and you see the whole movement, not just a small part of it.

Someone uses the standard scale and starts scalping on a 5-10% scale and then gradually moves to a larger scale, which allows them to sit out larger profit trades and not trade small movements.

If you have the 10% button pressed, one cell is 1% and you can visually estimate the size of the rise or fall of a coin. In addition, on the right side below the horizontal cursor line, a percentage of scale is displayed, using this measuring tool, you can quickly check the distance in percentage from the price line up or down.

You can disable or enable the display of the scale on the cursor bar in the Settings - User Interface - Scale Tool tab.

You can also measure the percentage of growth or decline using the "Rectangle" drawing element. You can do this by selecting it in the Pencil (Draw on the chart) button, which is the rightmost item. Then, while holding down CTRL, left click on the chart and while holding down CTRL, drag the line up or down. The line will become a rectangular area with percentages on the left side: up to measure growth, down to measure fall in price.

The tool is quite handy and complements previous methods of working with scale and measuring the percentage of change in the price of coins.

That is, on the 10% button, the graph can be manually stretched to 20% or narrowed to 5% with an arbitrary scale within this range.

To do this, place the mouse cursor anywhere on the graph, press the right mouse button and hold it down to zoom in up to 20%, with the graph visually zooming out or down to zoom in up to 5%, with the graph visually zooming in.

With this method, you can quickly adjust the scale of the chart without having to flip the fixed scale buttons. The manually scaled scale will only act on the current coin and new coins to be opened in the bot, when the 10% button is pressed, will open at 10% scale, ignoring the scaling.

If you want to reset the chart to the original 10% scale according to the button, click on it again and the chart will reset to the original 10% scale.

For automatic strategies, it is mandatory to switch the button to "Mode: Signals", as only in this mode, auto strategies are allowed to buy, but of course, if the strategy is activated, it has AutoBuy=YES buy permission set and AutoDetect enabled.

In "Mode: Manual", auto-strategies will not be allowed to buy coins in any case, you can only buy coins manually.

If you don't need strategies to buy while you are trading manually, you can simply click "Manual Mode" and use only strategies detects, but no autobuy, in order not to disable detects or change autobuy settings in strategies from AutoBuy=YES to AutoBuy=NO.

If you need a universal mode of operation "both manual and strategy-based buying", it is recommended to switch this button to "Mode: Signals", because this mode is more universal, both for manual trading and for auto-trading by strategies.

The MoonBot FAQ directory has a menu with questions and answers grouped into several topics:

- General questions

- Cost

- Training

- Bonus programme

- File system

- Interface configuration

- Strategy settings

- MoonBot and Telegram

- Control via Тelegram

- General errors

- Log errors

- Log entries

- Statistics

- Development and testing

- Help

Alternatively, you can read the full questions and answers for each topic by clicking the "Show All" button after selecting a topic. The MoonBot FAQ directory is regularly updated with new information.

Just below is information with deltas for 3 hours, 1 hour and 15 minutes, as well as hourly and daily volumes on the current pair.

Below are the Buy, Cancel Buy, Panic Sale and Order buttons.

The Lock button is to add this coin to the bot's global blacklist,

Asterisk button - add a coin to your favourite list,

Button Eye - where the movement is, the most volatile coins at the moment,

TradingView button, clicking on which will open an overview of the pair on the TradingView website,

The chart button will open a candlestick chart on the TradingView website

The Twitter button will open the Twitter page of this coin.

Below is the Share button for social trading, which you can read more about here: https://moon-bot.com/en/72-social-trading/

There are also two buttons below which enable iceberg mode on Buy or Sell orders respectively.

Even below you can see the minimum lot size on this coin and the maximum possible order size.

An indication of whether multi-order mode is enabled or disabled, the number of Buy and Sell orders on that coin and its current price.

If you double-click on "Comment (double-click to edit)", a field will open where you can write a small comment on a specific coin.

In addition, after restarting the bot, the "Comment (double-click to edit)" will not appear on all coins, even those without a comment edit, as this implies that you have found and used the field and no longer need these prompts.

Coin comments are saved in the data file \ CoinsComments.txt, if you clear the contents of this file and restart the MoonBot terminal, the "Comment (double-click to edit)" prompts will appear again on all coins, but this is not necessary, because if there is no "Comment (double-click to edit)" you can still write comments on coins, move your cursor to this location so it changes its icon to "arrow with white rectangle" and double click the mouse.

To do this, write the data \ CoinsComments.txt file as a column in the format:

BTC=Comments1

ETH=Comments2

BNB=Comments3

LTC=Comments4

Save the file, reload MoonBot and all these coins will show all the recorded comments from the data \ CoinsComments.txt file.

Below are the API limits for the current connection to the exchange (for spot trading there will be one limit, for futures trading there will be another). Connections to the Web Socket - OK

Trades and Latency, which shows the delay of trades from the exchange as well as the value of the PriceBug parameter, CPU load, system load and memory usage.

At the very bottom is information on whether the separate Moon Streamer service is enabled (ON) or disabled (OFF), which can be configured by clicking on Settings. Moon Streamer is a separate server located in the Tokyo location, which sends current trades from itself over a UDP connection. If your direct connection to the exchange is not stable, a Moon Streamer connection can help you see the chart in real time. This is effectively an additional redundant channel for sending charts to your MoonBot terminal. If you're trading on a VDS (remote server) there's not much to gain by using Moon Streamer, it's mainly useful if you're trading on your local computer. Moon Streamer is an optional paid module which can be activated for Moon Credits in a separate window.

O: is the total number of all active Buy and Sell orders in the bot E: is the current and slash maximum number of errors in the bot

You can click on this and this will open the Moon Credits window, which contains a list of additional paid modules that are activated for Moon Credits and allow you to expand the bot's capabilities. This window can also be accessed by clicking on the

Settings - Unlock press the phrase "Moon Credits".

Important note! If you have many bots (more than 3) connected to the same telegram account (assuming different bots, servers, clients), this can lead to serious delays or even loss of messages, i.e. not all messages may reach the bot.

To receive bot signals from telegram channels you need to

1) Click the "Enable built-in client" checkbox and log in to your Telegram account directly in the bot.

2) Or you can download an alternative Telegram using the button on your screen (the standard bot app will not work) and log in to your account. You need to register a new Telegram account only in the official Telegram, and enter the data of your existing account into the alternative Telegram (registering a new account in the alternative Telegram may result in a ban). After that, instead of the download button, there will be a Start Alternative Telegram button, click it.

3) The list of channels you are going to work with is created manually by adding the required channels using the "Add Channel" button (the required channel should also be added to your Telegram account). The name of the channel should be written without the "@" sign and without the prefix "https://t.me", for example, the channel https://t.me/HighestPump is called "HighestPump".

4) Once the channel you have added appears in the list, tap on it, then in the Channels with signals line:@(your channel name will appear here)

The MoonBot stores all messages received in the bot\logs\LOG_ADD_ХХХХ-ХХ-ХХ (depending on the date). The MoonBot terminal also has a built-in Telegram client. To enable it, you need to:

1) Check the "Use built-in client" box.

2) Enter your phone number, SMS code, password.

3) If necessary, you can specify a proxy server (socks5 or MTProxy). If you cannot connect to Telegram without a proxy, the bot will automatically enable the built-in MTProxy, you can then change the proxy server to your own.

4) The built-in client can be run simultaneously with the alternative client, thus receiving signals from 2 Telegram accounts.

5) Activate/deactivate the built-in Telegram client by ticking the box in the settings.

How it works: Experienced users (with a rating of 4 or more), when they find a coin that is too risky to trade, right-click on the "Share" button in the main MoonBot terminal window and open the "Share market" window, which signals them to add the coin to the temporary blacklist.

The signal indicates the duration in minutes and the risk level from 1 to 3:

1) Pips - risks in trading up to 2%;

2) Deep - the risks even on deep bypasses are 5% to 10%;

3) Deadly - extremely dangerous (delisting, scam, threat of losing your deposit).

Your MoonBot, if you have enabled the "Use shared BlackList from the @Moonlnt channel" (Coins are beeing posted in our channel @MoonInt) checkbox in the Settings - Telegram tab reads these signals and applies them to all your strategies. In each strategy, you specify the level of risk, starting from which the strategy should not work (tab Filters in the strategies, parameter MoonIntRiskLevel, the default value is 2, that is, the strategy will not work, if there was a Deep risk level blacklist signal). If you put a value of 4 or more, the strategy will ignore all blacklist signals, because the highest level at the moment is 3 (Deadly).

To set up the detection of Telegram signals you must use the settings on the Settings - AutoBuy tab in the "Detect coins in Telegram" area, there set the "Advanced filter" setting and write the filters you want below. The bot can also detect signals in clipboard text, this can help test your filters - use the settings in the "Detect coins in Clipboard" area for this.

If the "Mode: Signals" button is pressed, MoonBot will buy coins based on the signals found automatically.

If the "Mode: Manual" button is clicked, the MoonBot will display market charts based on the signals found, but it will not auto-buy.

The "Auto BUY from Telegram" checkbox is responsible for automatic purchase when a coin is detected in messages in your chosen Telegram channels. The bot's connection to the Telegram channel must be set up. If "Auto BUY from Telegram" is unchecked, the order will be placed according to the main settings of the MoonBot terminal, if checked, the orders will be placed according to the Telegram strategy.

You need to enable the "Advanced filter" option to configure the buy parameters.

Detect by Token" and "Detect by Full Link": Detect a coin by the name of the token in the message or by the full link to the exchange. For example, vTorrent coin (Bittrex exchange). If you set detection by full link, MoonBot will only buy it if the message contains a link to that coin. On the Bittrex exchange, it looks like https://bittrex.com/Market/Index?MarketName=BTC-VTR. If setting detection by token, MoonBot will buy when it detects the word VTR, highlighted by spaces, inverted commas, dashes, etc. For example, "BTC-VTR" or "VTR". Token detection should be used with caution!

The "Dont Buy Forwards" and "Dont Buy Reply" checkboxes determine whether or not to buy coins from a forwarded or reply telegram signal.

"Keywords (comma separated) in Long signal": a list of keywords (separated by commas) that MoonBot looks for in the message. MoonBot will place a buy long order if it finds any of the words from your list in the message.

"Buy if distance between token and key word less then (N) words": Normally, a signal message will have a keyword next to the token (for example, "Buy some #NEO", with 1 word "some" between them). In other messages like weekly reports or general discussions, the keywords and tokens are further apart, which helps to filter such messages.

"Buy tokens tagged with": a list of tags preceding a token. This option helps the bot distinguish real buy signals from empty information in the signal channel. For example, if you leave the default tags "#, $", then "Buy #START" or "Buy $ START" will be treated as signals, whereas "START buy coins" will not be a signal.

"Blackwords (comma separated) in message": a comma-separated black list of words in the message that MoonBot will not buy if detected. Typically, these are words used in old signal reports ("we gave #NEO signal last week", "we called #TRIG", "#NEO raised 68k", etc.).

"Words count in message less then": total number of words in the message (including links and numbers, dates, prices). Helps the MoonBot terminal to distinguish real signals from long general discussion messages.

"Words in message to buy at lower price": In some cases, channels do not specify a buy price but suggest to buy at a lower level, then you should specify a list of such words and set how much lower from the current price a buy order should be placed.

If you have checked the box "Words in message to buy at lower price", two additional sliders are unblocked: "Buy for market price N%" and "Auto cancel lower BUY after M minutes".

"Keywords (comma separated) in Short signal": a list of keywords (comma separated) that MoonBot searches for in the message. MoonBot will place a buy short order if it finds any of the words from your list in the message.

"Buy tokens tagged with": if checked, you can enter comma-separated tags in the field below which will autopurchase

"Tokens without tags": if checked, autopurchase will also be possible by untagged coin name, e.g. "VTS".

"Links": the autopurchase will be possible if you specify in your signal the link to the exchange where the coin to be bought is traded.

"Special": use special token spellings, e.g. C O I N, (C) (O) (I) (N) etc.

"Buy if only 1 token found in message": usually the real signal message contains exactly 1 token, so in most cases you should enable this option. There may be rare exceptions. If you uncheck this box, the bot will select a token that is repeated most of the time, e.g. an ETH coin will be selected in a message of the form: " BUY #ETH, #ETH will go to the moon like #BTC".

"Buy only if price specified in message": MoonBot checks if there is a buy price in the signal message. If there is more than 1 price in the message, the bot will take the maximum price of all message prices that are lower than the current market ASK, but no less than 15%.

"Use specified price from the message": MoonBot will use the price from the message to buy and will place a buy order at that price. If the price in the message is higher than the current price, the buy order will be placed at the market price.

If the option "Use specified price from the message" is checked, then an additional slider "BBuy for specified price +N%" is enabled, by means of which it is possible to increase or decrease the price from the message as a percentage.

"Use Stops, TakeProfit in message": if checked, since the minimum price in the message is usually a stop loss, a stop loss will be placed at this level after buying the coin. The second price after the buy price is usually the price of the coin, at which the profit should be fixed, in this case, when it reaches this take profit, MoonBot will set a trailing stop and thus fix the profit, if the price goes higher, the trailing stop will accompany it higher, if the price goes lower, the take profit will be fixed at the last trailing stop position. The Sell order in this strategy should be raised higher than the price indicated in the message (e.g. by +30%).

Configure MoonBot to receive WebHook commands.

Go to the Settings - AutoBuy tab and check the "Detect by TV WebHook" box.

To the right of this item you will see the URL you want to use when setting up notifications in TradingView.

Also it is necessary to make some adjustments for MoonBot terminal to read tokens in messages:

1) Check the "Advanced filter" checkbox

2) Check the "Keywords (comma separated) in Long signal" box, unless you are using the keywords in the message as a filter.

3) The checkbox "Buy tokens tagged with" is needed to buy on messages where the token is specified as ***BTC. To do this you need to put # in front of the token to get for example: #ALGOBTC. Without this checkbox, MoonBot can buy if the message contains just a token, for example: ALGO.

4) The rest of the parameters are described on our website https://moon-bot.com/en/manual/signals-trading/ and you can configure them as you wish.

There are many options for messages and settings, you can customize them as you like.

Please note, the bot will not buy messages with such ALGOBTC token, you will need to remove the VTC or set the # tag, as described above.

Next, you need to configure the Telegram strategy as for normal Telegram signals using regular messages or you need to put a tick in the Menu strategy settings - AcceptCommands=YES to accept trust management commands in the messages.

Read more on this topic here: https://moon-bot.com/ru/78-web-hook/

Please note that you need to activate it in the MoonBot terminal in the Settings - Unlock tab for 100 Moon Credits in order to use the functionality of receiving commands instantly from TradingView with webhooks.

1) In the Settings - Telegram tab, connect Telegram to MoonBot and add a channel from which you will receive coin buying signals.

2) On the Settings - AutoBuy tab: In the "Detect coins in Telegram" area, uncheck "Auto BUY from Telegram" and check "Advanced filter".

3) In the tab Settings - AutoBuy: in the "Signals detection rules" area, check the boxes and settings, according to your needs to sort signals reading. More details about settings here: https://moon-bot.com/en/manual/signals-trading/

4) In the main window of the MoonBot terminal, click the Strategies button and create a telegram strategy in the strategies window:

a) In the Main - SignalType parameter select "Telegram".

b) The ChannelName parameter should be set to the channel name from the list you created in the Settings-Telegram tab.

c) In the ChannelKey parameter, specify a keyword that matches the keyword from the settings tab - AutoBuy in the "Keywords (comma separated) in Long/Short signal".

5) Next you need to set the rest of the parameters in the telegram strategy (buy conditions, sell conditions, stops, trailing, etc.).

6) Then click on the Save button and save the telegram strategy.

7) Then check the box next to the telegram strategy and click on the "Start Checked" button to activate it, a light will light up next to the activated strategy.

8) Wait for the buy signal from the Telegram Channel and check the operation of the Telegram strategy to buy the coin.

If you have difficulty with the setup, please contact the Moon Bot Public Telegram Group for free detailed advice: https://t.me/Moon_Bot_Public or take paid training at MoonBot Academy English (contact Kost Main https://t.me/kostmain for access to this group).

If this mode is enabled, the bot will immediately warn you that you will be switched to the emulation mode, in which real orders on the exchange will not be set and the real balance will not be affected, all transactions plus or minus will be reflected only in the bot and the exchange will not get. If you agree to the warning, the bot will switch to the Emulation mode and the red "EMULATION" inscription will light up. A checkmark will be placed in the Menu next to the phrases Emulation mode, which also indicates that Emulation mode has been activated. If you go back to the Menu and uncheck the Emulation mode, the bot will immediately return to real trading mode without additional warnings and the "EMULATION" inscription will disappear.

In "Emulation mode" you can even place orders on charts with zero real balance, but then the orders will be placed with a minimum order of approximately the equivalent of $15.

Therefore, at the beginning you can test strategies and trade hands in the "Emulation mode", but to get more accurate results, taking into account pings, data forwarding, price slippages, we still recommend to test real trading with a minimum order, which will give you results close to the real ones.

Warning! Coin sales via Balances are only available to PRO version owners.

Floating mode is set by default at the bot's initial startup and allows you to set the size of the order with the slider as a percentage of the free deposit. If you select a fixed order size, instead of a slider, 6 fixed buttons appear in which you can set the values you want in convenient increments. It is also possible to quickly switch between these modes if you click on the phrase "Use ХХ$ for buy order".

1) If you select Fixed, then six buttons appear on the main window of the MoonBot terminal for fixed size Sell orders.

2) If you select Float, then a slider will appear on the main window of the MoonBot terminal to set the size of Sell orders smoothly.

You can also switch from one mode to the other by clicking on the phrase "Sell for [actual buy price]+X%".

We recommend you to choose Fixed mode and adjust its buttons to your desired step, in which case you can quickly clicking the right button to select the appropriate level of sale under the current situation on the coin, for example, when the series of the same shoots at +5%, then you can click the button with Sell Price at 5% and your buy orders will immediately close at the desired level of +5% and you will not lose time by manually moving the Sell order. For example, if you had a low Sell Price of +5% set at +1%, then you would have to manually move the Sell order higher to the +5% level every time to get a larger possible profit. Or, if you had a high Sell Price of +5%, for example +6%, the Sell order would not close quickly because it would be above the price break and would have to be manually moved lower each time to the +5% level.

- Use 30-secs old ASK price (the slider changes to: Buy for [price before pump started] XX%)

- Use current ASK price (the slider changes to: Buy for [current ASK price] XX%

MoonBot always analyses prices and you can place a buy order based on the minimum price of the last 30 seconds (+/- X% depending on your specified buy conditions) or on the current market price (+/- X% depending on your specified buy conditions). Normally this parameter is set to "Use 30-secs old ASK price", in which case this will keep you from buying at the peak of the price when participating in pummels.

- Use Main Settings

- Use Manual Strategy

If you select the item "Use Main Settings", you can trade manually on the main settings of the terminal by setting the necessary conditions: buy, sell, stop-loss, trailing, blacklists, etc., both on the tab "Settings - Main" and on the main screen of the MoonBot terminal.

The "Use Manual Strategy" item is for working with "Manual" strategies. Note that if there are no "Manual" strategies in the list of strategies, the item "Use Manual Strategy" will not be active.

If the price crosses such a signal line, an audible signal is emitted, which will be played with a set duration and a set number of times.

To the right and above the name of the trading pair there is a button with the name of the coin on which Alert was triggered and if you click on it, it will open a chart of that coin and then you can make the necessary trading decision according to the situation.

The alerts allow you to set them up in advance on the coins you want, so you don't have to look at the situation every minute to see whether the price has reached important levels or not, but only when MoonBot alerts you if these events occur.

In this table you can see the list of alerts, on which coin and on which kind of drawing item it is set, with date and time when the alert was set, and you can also choose the duration of the alert in seconds, choose its sound and number of times the alert repeats.

In this table with alerts you can also clear some or all of the alerts to avoid searching for them for a long time through all coins. In this case after the Clear button is pressed the graphic item will remain on the chart, but the Alert will be removed from it.

1) ResetSession coin | ALL

reset sessions on coin or on all markets

2) ResetSession ALL

this command will reset to zero all old sessions on ALL coins and all new sessions and all cPlus and cMinus counters on ALL coins across all strategies

- Use GPU Canvas

- Antialiasing

- Use ClearType

- RepaintOnMouseOver

- Use Direct2D

- Ignore Scale

- Smooth Charts scrolling

- Local Trades Time

- Fast OrderBook updates

- Use memory for charts: XX%

- FPS

- VDS optimized mode

- Login (Your_Login) and Password

- AutoLogin

- Autostart on windows startup

- Reset AutoLogin

It is possible to disable some settings or reduce the FPS if you have a weak PC. If you have activated the Moon Scalper module, you can enable the Smooth Charts scrolling checkbox and the chart will move more smoothly. In addition, if you trade on a dedicated server, then you must necessarily check the box "VDS optimized mode", which reduces the load on the dedicated server. In the same menu you can also set up AutoLogin in Windows on server restart.

1) In Menu - System Settings - check the box "VDS optimized mode". It is highly desirable to set it, as this option saves server resources, less memory and CPU are spent on storing and drawing of charts, more resources are allocated to the algorithms.

2) In Menu - System Settings - set up auto-login in windows: enter your login and password from your Windows account and click "AutoLogin" button. You can also add the MoonBot terminal to autorun. To do this, click the "Autostart on windows startup" button in the same settings menu and restart your server for verification (hot restart via VDS control panel), the MoonBot terminal should automatically start and continue its operation after the operating system boots.

3) Be sure to disable Windows and Defender updates! Otherwise, during update the system may close the bot, and the orders will remain hanging on the exchange.

4) Be sure to disable "Automatic Daylight Saving Time and back" on the VPS, or better set the time zone to "(UTC) Time in UTC".

5) When running Mshots with short price interval (up to 0.5% of the difference between MshotPriceMin and MshotPrice), it is recommended to use new parameter MShotAddDistance=50, and MShotUsePrice=Trade. In this case, the price for order rearrangement will be taken by the price of the last trade, and the bot will rearrange orders faster. This is especially relevant when trading futures.

6) In strategies focusing on fast trading (MoonShot with short interval, MoonStrike, Drops with small drawdown) it is recommended to use a non-zero value of the HFT parameter (an integer).

7) In tab "Settings - Autostart" we recommend to enable option "Auto Stop if errors level > = 3", number of errors API should be equal to 3 or 4. Restart at the earliest after 20 minutes.

8) You can also use the "Auto Stop if Ping > 1000 ms" checkbox in the "Settings - Auto-Start" tab. The ping threshold is adjustable from 100ms to 2000ms. If the ping has increased, then most likely you have a problem with the internet or lags occur on the exchange, in which case there is a great risk of losing order controllability and then you can use this protection to avoid trading in times of high pings.

Clicking on this item will open a separate window where you can enable and configure the Moon Streamer service, which is a separate server located in the Tokyo location that sends the current trades from itself to your computer over a UDP connection. If your connection to the exchange fails and trades are momentarily lost, then the MoonStreamer connection can help you see the chart in real time.

If trading on a VDS (remote server) there is no benefit to using Moon Streamer, it is useful mainly if trading takes place on a local computer.

Under "Order Status" there is a menu where you can select orders with different statuses:

- All show all orders active and closed

- Active only - show active orders only

- Closed only - show closed orders only

- All incl. deleted - show all orders that are active and closed, including deleted ones.

Nearby you can select the period for which you want to view the report and also show or hide some columns in the report.

To see the report of your trades made in the "Emulation mode", you need to tick the box next to the word "Emulator" and the table that will appear will contain only emulator trades. If to remove a tick mark, we will see the table with other data already with transactions at real trade taking into account our real deposit.

If you need to view trades for a specific period of time, check the "From" and "To" box and set the desired date and time underneath. If you need to view the report from a certain date to the current day, you can either uncheck "To" or set a future date under the "To" checkbox, for example the end of the current year.

For a quick report for today, you can check the box next to the word "Today" and set the time.

In this case you can see all today's deals starting from the time you set, if it is 00:00 then all deals of the day from 00:00 will be shown in the report, if you set for example 12:00 then you will see deals of today, but from 12:00 till the current time.

At the top of this window, you can see two filter fields, which are useful for quickly sorting the information in the table by coin, strategy, profit, loss, and so on.

For example, you can enter a coin name and get a list sorted only by that coin.

Or you can enter a strategy name and obtain data only for this strategy.

The second field will help you to get more detailed information in the pre-sorted report, for example, you can write a minus sign in this field and see only all minus trades in the report or write a plus sign and see only all plus trades.

In the upper right corner, click on the spanner icon and an additional settings menu will open on the right.

In the "Lines" field you can set how many visible rows you want to display in the reports table (from 50 to 1000). Total results of deals, which are displayed in the lower right corner of the table with reports, are still counted for all deals of the selected time period, including those not visually displayed in the table with the report. Note that the lower this number is, the faster the reports run.

To view a complete report of transactions, click on the button "Export to Excel", unload the report and further review and analysis of this report in Excel.

You can change the columns displayed in the report and leave only the columns you need at the moment.

You can set up which columns to show and which to hide by clicking on the icon with a spanner in the upper left corner of the reports window.

This will open a list of column names on the right, if checked the column will be displayed in the table, if unchecked the column will be hidden.

You can set the option to compress columns or not, and also to display in the report the average order with or without a leverage.

In the top right corner of the reports window there are two buttons to export the report into .csv format or into .xls format for further analysis and sorting in Excel or third-party programs.

All the strategies, except for MoonShot, fix these deltas at the time of the detection and at the time of placing a buy order. For the MoonShot strategy, these parameters are fixed in the report at the time of buying the coin, since the MoonShot strategy has no detection, and its orders are placed in the stack and wait for a shoot-through and buy of the coin.

Clicking on the name of the coin in the table itself will open the "Pump Helper" window, which will open a snapshot of charts and deals on them, these reports are also interactive, they can be stretched horizontally or vertically, and you can zoom to better view the entry and exit points of the deals. In addition, the deltas for 3 hours, 1 hour and 15 minutes, as well as the hourly and daily volumes of the coin, will be recorded on this mini chart.

Below the tabular data on the right side will be a general report on the selected data according to the date and filter settings.

- This report will display the following data:

- Number of orders in the selected report

- Average order size in the currency pair without and with leverage

- Total profit or loss amount

- Total profit or loss percentage of an average order.

Click on the line you want and at the bottom of this table in the information window, you can see more detailed data on the trade:

- Date of deal closing

- Real or emulator trading mode

- Name of strategy

and system parameters of the bot:

CPU load, system load, API limits, PriceLag percentage, Latency, Ping and other data.

You can selectively delete some or all rows of trades from this report by clicking on the "Delete" button.

If you then want to see a report with deleted trades, you can do so via the menu "All incl. deleted" (show all active and closed orders, including deleted orders).

In the bottom right corner of the "MarketsTable" there is an "Export to csv" button that allows you to export data from this table into .csv format for further analysis and sorting in Excel or other third-party programs.

What are the fields and buttons at the bottom of the MoonBot “MarketsTable” and what do they mean?

This button and the settings in it work only for owners of the PRO version of MoonBot with the Moon Scalper module activated.

If you click this button, the chart will show the vertical trading volumes, if you release it, the volumes will be hidden from the chart. These vertical volumes graphically show us in what place of the chart passed what volumes. If green volumes prevailed, then buyers pressured the market, if red volumes prevailed, then sellers did. The change in volumes can give us an additional clue in which direction the price can move at the moment, and we can also identify the accumulation of buyers or sellers unloading zones, which after some time leads to an increase or decrease in price.

What are the advanced settings for the “Hvol” button (horizontal volumes) in the MoonBot terminal?

"PriceFrame": set the price step: if 0%, the bot will measure volumes for buying and selling at every price value (for example at 1000, 1001, 1002 etc.) if 1%, it will measure volumes in the 1% price range (for example near the price of 1000 the bot will show volumes at prices from 995 to 1005).

"TimeFrame": the measurement time, the maximum value is 48 hours. If you choose TimeFrame up to 24h, then volumes are calculated as trades, if more than 24h - as candlesticks.

"Width": the width of the histogram (in percent of the chart's total width).

"Opacity": the transparency of volumes.

Drawing tools allow the trader to make arbitrary entries on the chart, establish support and resistance lines, set Fibonacci levels and determine the percentage of volatility.

If the button is pressed, it is possible to draw and all drawn lines will be visible, if it is released, drawing lines from the chart will be hidden.

If you click on "Pencil" with the right mouse button, an additional menu with buttons and settings will open.

In this menu you must select and click on one of the items you plan to use.

To start drawing, it is necessary to hold Ctrl and by pressing the left mouse button draw the necessary element.

To remove an element, press Ctrl+Z or click on the element and select "Remove" in the menu.

If you want to change the position of the element, hold Ctrl, point the cursor to the editable part of the element (line, edge point, etc.) and you can edit and move it.

- Infinite horizontal line.

- Arbitrary sloping line (trend lines).

- Triangle.

- Fibonacci levels (level 0.618 is custom, you can drag this line holding Ctrl and LKM)

- Rectangle (a line with the price or, if it is stretched, a rectangular area with the percentage of growth or decline in price)

Line type, thickness, colour and transparency can be set up additionally in each drawing element.

The Remove All button removes all drawing elements on a chart that is open to the full screen.

A drop-down menu will appear, check the "Alert" option.

The pattern will change colour and the bot will watch the price in the given area.

When the price crosses the pattern, the bot will beep and the button of the market on which the alert was triggered will appear in the upper panel.

The list of all alerts can be viewed by pressing the "Alerts" button on the drawing panel or by selecting the "Alerts" main menu option. This will open a window with a list of alerts and settings.

You can selectively remove an Alert or a drawing item by right-clicking on the item and selecting Remove from the menu.

Then select the "Pencil" button in the "Pen" button and check the "Emulator" box.

To make drawing faster, it is necessary to expand the graph as much as possible, to do this, place the cursor on the graph and scroll the mouse wheel away from yourself.

For more comfortable drawing, press the "Auto Shift Chart" button (blue arrow) and move the chart to the left with the mouse.

Next, press CTRL and holding it, draw the necessary trajectory to the right of the price BEFORE the current trades. As soon as the chart line comes to the beginning of the drawn line, the "crosses" will run along this line, allowing you to emulate the desired price pattern and check the triggering of buy, put sell, activation of triggers, activation of trailing stops, etc.

To draw, use coins with "dense and saturated" trades, for example on a BTC coin, then the line of the drawn price will be more adequate and "nice".

If you need to emulate a shootout, you can put a point or short line below the price and then the price will fall sharply to that point or line.

The emulated price trajectory can be reset using "Menu" - "Reset charts" (for those who have the "Chart Sub Module" plugged in).

If you do not have the chart loading module connected, I recommend experimenting with the price line drawing on a separate bot, so that the price deltas do not affect the strategies in real trading.

You can show or hide them on the Settings - User Interface tab by checking or unchecking the boxes next to the labels:

- Show LOG window.

- Show orders window.

In the orders window you can see your orders and each order has information data:

Order type: SELL (sell), BUY (buy), BUY+ (pending order).

Order number.

If the index is i, the order is an iceberg.

If the index is E, it is an emulative order.

Amount of coins purchased (number of coins purchased / maximum number of coins for the order)

Stop Loss (turn ON or turn OFF).

Trailing Stop (turn ON or OFF).

Vstop Stop by volume in the order book (turn ON or OFF).