"BINANCE FUTURES" ADDON

Attention! T his type of trading is very risky and can lead to the loss of a large share of your deposit.

Before engaging in Futures trading, we kindly ask you to carefully study all

inherent and underlying risks, as well as acknowledge all possible risks.

Binance Futures is an additional module that allows trading Perpetual Futures Contracts on Binance from x1 to x125 leverage, which means that when you deposit $1,000, you can operate with orders of $125,000. This way you can earn on both the growth and depreciation of Bitcoin by going “LONG” (betting on its future increase in value) or “SHORT” (betting on its future decrease in value).

This module will also allow trading Quarterly BTCUSD Future Contracts.

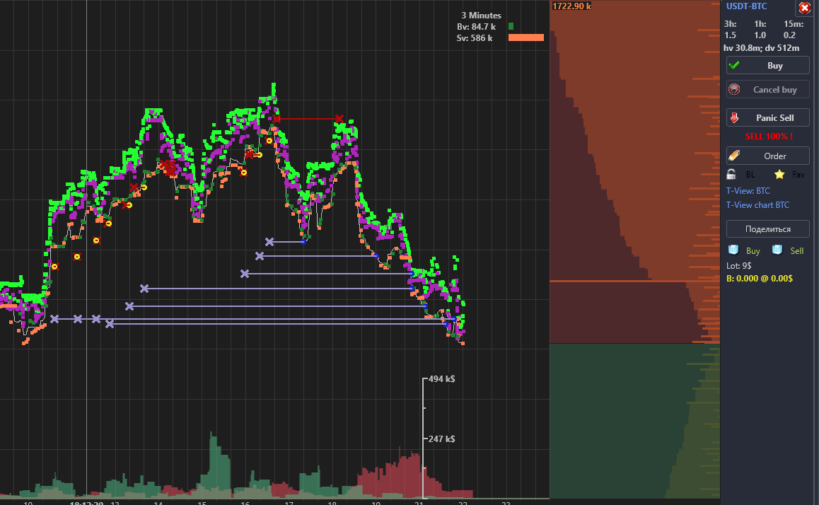

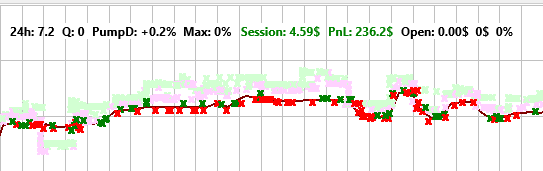

Example of profiting by “shorting” BTC just before a price drop.

This add-on will work only if the PRO version is active. The activation procedure for the add-on is described in MoonBot in the PRO tab (there you can also activate the trial period which is only available for PRO version users). An activated Moon Scalper module is not mandatory, but will allow for multiple order placement (buying-up/increasing a position) as well as going “long” and “short” on a currency simultaneously.

Setting up and running the “Binance Futures” module

Necessary actions:

- You need to activate the futures account on the Binance website.

- Transfer some funds to a futures account (minimum lot is $10).

- Create new API key pairs with the permission to trade futures (when creating keys, you need to edit permissions and check the “Enable Futures” checkbox).

- Make a copy of the current folder with the PRO MoonBot in order to create a separate bot for futures trading.

- Make sure that you have the PRO version after you run it.

- Next, open the settings on the Login tab and select Binance Futures from the Exchanges drop-down menu then click Apply.

- Then you need to click “Register other keys” and enter new API keys and click “Register keys”.

- For free limited testing, you must activate the trial period in the PRO tab. The trial period is 7 days with a “real” order size limit of 30$ without taking the leverage into account (i.e. depending on the selected leverage, the order size can range from $30 to $3750).

Basic settings and controls

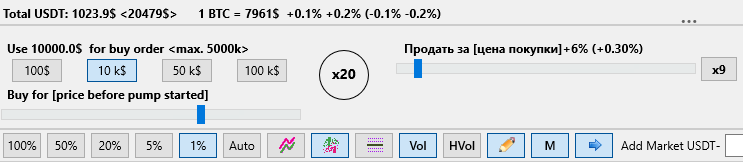

The deposit is displayed in USDT according to the actual amount and in <brackets> wehn applying the exposed leverage. Changing the leverage is only possible when the chart is open in Full Screen. To adjust the leverage, click on the x20 and adjust the leverage according to your requirements then click Apply. Note: the selected leverage will be applied to the account and will thus applied on all other bots, e.g. the ones trading on strategies. Also, you can change with one click the leverage to its maximum value or a certain one for all pairs. To do so, open the "Show Markets" window and use the controls on the bottom of it

For convenience, a 1% chart scaling option has been added.

The size of the order is set, taking into account the exposed leverage.

The percentage of profit is shown by 2 numbers, the first — percentage of profit taking your leverage into account, second — in brackets, the actual percentage change in Bitcoin price.

When using Stoploss, it will be multiplied by the set leverage (x20 leverage is set by default) and, accordingly, when Stoploss is at -1%, in fact, taking into account the leverage, the losses will be n-times higher, although visually, on the chart, Stoploss will stand at -1% of the purchase price.

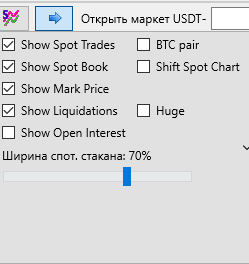

This button allows configuring the display of spot market trades and order book as well as the mark price.

To display the spot market, you must agree to send trading statistics to our server.

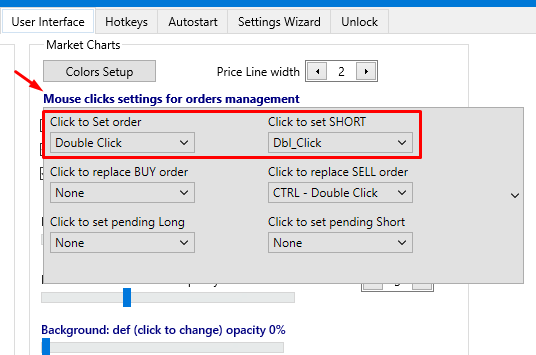

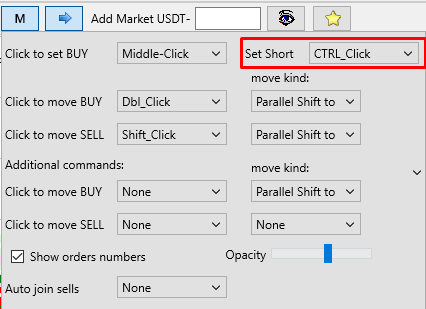

The long or short orders / long or short positions are placed according to your Main Moonbot Settings

in the User Interface tab or the Multi-orders settings window as a functionality of the “Scalper” addon.

Please make sure that the hotkey functions do not overlap.

The Bot’s interaction with orders and positions

An executed order (“long” or “short”) opens a position, the bot immediately places a counter order for closing (“short” or “long”, respectively), similar to Sell orders on regular (spot) trades. A closing order, within the Bot is called a SELL order regardless of whether the order is “long” or “short”. Nevertheless, your Bot may have multiple orders open at the same time in either direction. We highly recommend that you train on the smallest possible orders for a better understanding of the mechanics of the underlying operations.

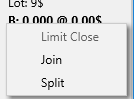

This is the information about your current position, displaying its type: L – long; S – short, the size of the position and the average entry price. This example shows a long position of 1,18 BTC with an average entry price of 8495. When clicking on this entry, a drop-down menu will appear (see below).

Limit Close – Sets an order limit for closing an open position (if the position is open but there are no orders i.e. you’ve cancelled them or you’ve been placing orders outside of the Bot — this will set a limit).

Join – joins SELL orders.

Split – splitting the order in 3.

Apart from the Futures trades, the chart displays spot market trades, these are displayed in pale (faded) colors and are there to offer a view of current trends on the spot market.

The red line on the chart reflects the liquidation level for the current position. Please make sure that the liquidation level is far from the current price to not risk losing your deposit.

PnL – Profit and Loss, displays the all-time aggregate profit/loss of your Futures trading account minus commission (can be hidden from Settings > Interface menu).

Important: commission calculations, within the Bot, may be wrong due to varying maker/taker commission and varying VIP tiers. Always keep in mind that the result of any trade may vary up to +=0.2%, always use the aggregate balance for reference.

Important: when ticking the "Short" box in the Drops, Volumes and Delta strategies, the direction of the detect doesn't change. The only thing that changes is the direction of the order, thus the strategy will place a Short instead of a Long.

Particularities and important recommendations

We highly advise you NOT to go ALL-IN! Given that we perform margin trading activity, when all available balance is being used to enter a position that displays negative current PNL, which at the same time diminishes your real-time available deposit, please note, that there is a high chance to fail to place a sell order in Moonbot, returning “Insufficient Margin” error. Please pay close attention to the available deposit, especially if using all balance to trade.

Important: Please note that when trading with an isolated margin, it is possible that your position can be liquidated instantly after opening the position, because Mark Price is too far away from the current price, and also farther than the liquidation price of your position (especially relevant on a high leverage). To avoid this, the MoonBot strategies have MarkPrice (MarkPriceMin, MarkPriceMax) filters, you can read more about them in MoonBot or on the website here. When trading manually, you should follow the MarkPrice price by yourself to avoid liquidation.

Balance is updated with a certain delay due to API limitations.

Key combinations for placing pending limit LONG and SHORT orders are configured in the Interface tab.

Specifics of setting up Short strategies:

1. All strategies except MoonShot, MoonStrike and Liquidations do not flip the detect conditions, i.e. if you enable Short in Drops, the detect conditions do not change when the price falls and the triggered detect will place a short order instead of a long.

2. For short orders, the negative values, with a minus sign, in the stops, trailing and other elements do not need to be changed manually, the bot itself will flip those values.

3. The ratio BV_SV in the filters and stops will also be flipped by the bot, i.e. for short strategies the bot will determine the ratio of sell volumes to buys.

When tuning your strategies, don’t forget to take the set leverage into account, all values will be multiplied by the leverage. We recommend testing such strategies, for expected results, using small order sizes to ensure.Lowering the leverage requires sufficient available funds to cover the open position using the new leverage multiplier.

We do not recommend trading on more than one Bot simultaneously because you are running the risk of being short deposit size or increasing your position if such a position was already previously opened by a different Bot. The partial or total closure of a position is possible if another bot opens a position in the oposite direction (position is long, bot opens short or vice-versa).

In case of any kind of technical failure, you can always cancel all orders in the Bot and right-click on the level where the position is set and select Limit Close – this will set an order for the closure of the current position.