Getting started

Simple Auto-Trading

Simple autotrading in Moonbot allows you to automate part of your trading actions based on predefined conditions. In this mode, the terminal not only monitors market conditions but also opens and closes trades automatically according to specified rules.

This step is a logical continuation after working with detectors. While detectors were used for alerts and analysis, autotrading enables the terminal to execute trades automatically. This section covers the basic principles of simple autotrading suitable for beginners and demonstrates how to approach automation consciously and with risk control.

What Is Autotrading in Moonbot

Autotrading in Moonbot is a mode in which trading actions are performed automatically based on preconfigured strategies. The terminal independently monitors the market and, when certain conditions are met, opens and closes trades without user intervention.

Unlike detectors, which are used for notifications and market analysis, autotrading executes real trades. The user sets up the strategy logic in advance, and the terminal executes it based on current market conditions.

For beginners, autotrading is recommended in a simple and controlled format — with minimal order sizes, limited conditions, and mandatory pretesting. This allows a gradual transition from manual trading and detectors to automation while maintaining control over risk.

Autotrading in Moonbot is a logical next step after learning detectors and allows users to apply automation responsibly, building on their understanding of the market and the terminal.

How to Configure Autotrading Strategies

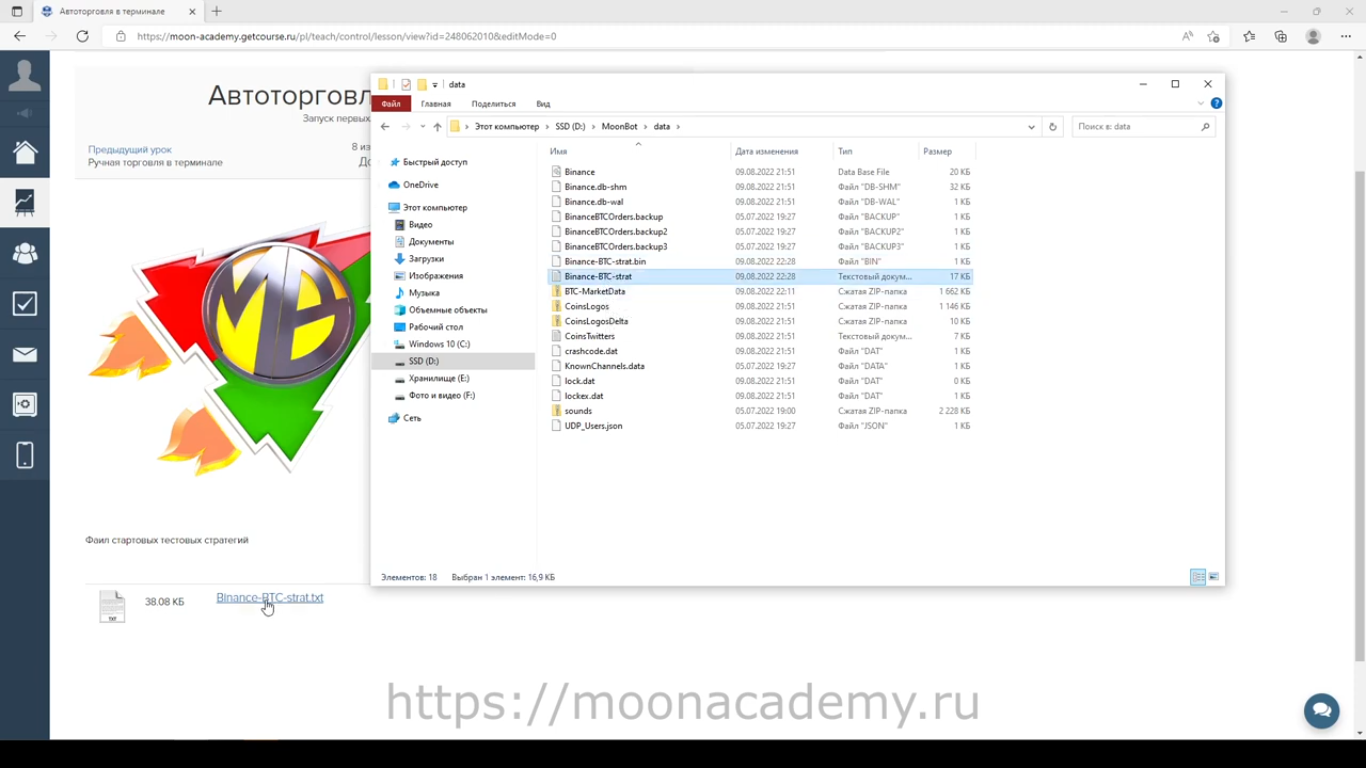

Autotrading strategies in Moonbot are configured in the Strategieswindow, accessed via the “💡 Strategies button” in the top right corner of the terminal, in the section for managing detectors, strategies, reports, and markets.

The Strategies window displays the full list of user-created strategies — both signal-based (detectors) and those configured to execute trades automatically. Here, you can create new strategies, edit existing ones, and control their activation state.

Autotrading strategies are configured similarly to detectors. The key difference is that autotrading includes automatic trade execution enabled in the strategy settings. This allows the terminal not only to identify market conditions but also to act on them.

The Strategies window is the central interface for managing automation in Moonbot. It allows the user to define which strategies are active, which are on standby, and in which mode (real or simulated) they operate.

For a more detailed overview of autotrading strategy settings and available parameters, we recommend referring to the terminal documentation.

Recommended Reading:

Enabling and Stopping Autotrading

Autotrading in Moonbot is managed via the Strategies window, accessible through the 💡 Strategies button in the top-right of the terminal.

Once an autotrading strategy is configured, ensure it is activated by checking the box next to it in the strategy list. A checkmark means the strategy is allowed to run.

To start autotrading, click the Start Selected button in the Strategies window. The terminal will begin executing all selected strategies based on their configurations. If automatic trade execution is enabled, the terminal will open and close trades automatically when conditions are met.

To stop autotrading, simply uncheck the strategy or use the stop button (if available in the UI). Once stopped, the strategy no longer monitors the market or executes trades.

In short, enabling and disabling autotrading is fully user-controlled through the Strategies window, making it easy to start or pause automation at any time.

Example of a Simple and Safe Autotrading Setup

For your first steps in autotrading with Moonbot, it's best to use the simplest strategy possible with minimal risk. The goal is to demonstrate how automated trading works, not to maximize profits.

You can base your simple autostrategy on an existing signal detector but with automatic trade execution enabled. In this case, the terminal not only detects the target market situation but also executes trades accordingly.

When setting up the strategy, it’s important to:

-

Use the minimum order size allowed by the exchange

-

Avoid complex filters and multiple conditions

-

Enable automatic trading only after testing the strategy

-

Preferably start in Emulator Mode.

This approach lets you observe how trades are opened and closed, how they appear in the interface and reports, and helps you understand how autotrading works — all with minimal risk.

Simple autotrading serves as a bridge between manual trading/detectors and full automation, allowing you to maintain control while learning.

Summary: Simple Autotrading

In this section, you’ve learned the basics of autotrading in Moonbot and how to use automated strategies in a simple, controlled way. We’ve covered what autotrading is, how to manage strategies, how to start and stop automated trading, and explored an example of a safe strategy for beginners.

Simple autotrading builds on the work you’ve done with detectors and allows you to automate trading actions based on predefined rules. A thoughtful approach to strategy setup, starting with small volumes and testing in advance, helps reduce risks and gradually leads you toward more advanced automated trading scenarios.

Video Tutorial