SIGNAL AUTO DETECTION

The bot is able to detect cryptocurrencies pumps automatically, continuously analyzing market data in multithreaded mode with 3-seconds resolution. However It should be borne in mind that the bot is not intended to work in fully automated mode: you should control detection methods settings and found coins. Please don’t forget: the bot is a trading terminal to help you, not a money printing machine.

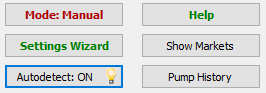

Auto-detection is turned off by default. To turn it on press the button “Autodetect” in the main window. Before the bot starts detection it should load historical market data; this is done on startup by default unless you turned off “Load historical data” in Settings.

In the version 2.50 the detection methods was significantly improved. Currently they are in beta-test status. Please don’t ask support about the best settings for the best profit. We will make soon some presets for autodetection; meanwhile you can help us by making some statistics of good detection, false detections, situation when a coin could be detected but was not, along with suggestions about used parameters.

There are 4 detection methods in the ver. 2.50. Two of them was in the bot from the beginning, we just exposed their parameters. Those 2 methods “SuperFast1”, “SuperFast2” was designed to detect flash pumps in case you know the exact time when a coin should be pumped, but you don’t the coin name. In the other cases its not recommended to use those methods because of a high false detect chance. Moreover, the method “SuperFast2” consumes significant processor resources and network traffic If you feed it with many coins to check (look setting in the bottom of this page). “SuperFast1”, “SuperFast2” are turned off by default.

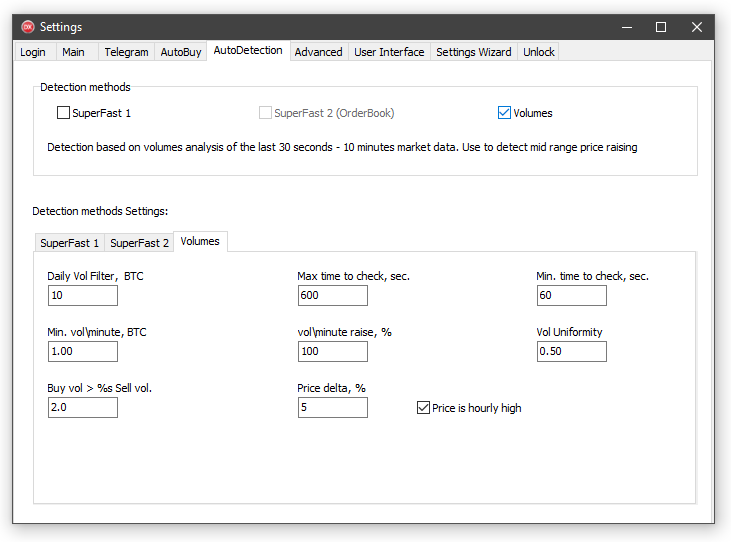

The third method “Volumes” is new in version 2.50.

Turned on by default.

The parameters defaults are configured to rather high sensitivity, so the bot will find coins frequently. You should manually control found coins, at least until you clearly see what exactly the bot is looking for. To do that, set the mode to manual in the main window, or set the buy price to [ASK-10%] and watch coins the bot finds for you. Think what would happen If you buy those coins immediately on detecting.

Daily Vol Filter: Initial daily volume is greater then specified value in BTC. Helps to filter out low-volume altcoins.

Max time to check, sec.: Max. period to analyze. If actual raising is slower then specified time, it won't be detected.

Min. time to check, sec.: Min. period to analyze. Helps to reject extreme fast pumps.

Min. vol\minute: Min. volume\minute, BTC. Its total buy volume during analysis time divided by analysis time. Helps to reject low volume random distortions. For example if there was 50 BTC injected in a coin in 5 minutes, then volume\minute is 5 BTC. If the same 50 BTC injected in the coin in 1 minute, volume\minute is 50 BTC.

Vol\minute raise: Volume\minute increase in compare to average volume\minute for this coin, percentage.

Vol Uniformity: Volume increase Uniformity (u: 0..1): If we detect buy volume V in first N seconds, then we expect at leaat u*V in next N seconds. In the other words, the bot expect 2 green candles, and you specify how high the 2nd one should be in compare to 1st one. If U=0.5 then the 2nd candle is at least half of the 1st.

Buy vol > x*Sell vol: Buy Volume x times higher then sell volume for the analysis period.

Price delta: Price raised during analysis period, percentage.

Price is hourly high: Current price at the moment of detection is hourly high.

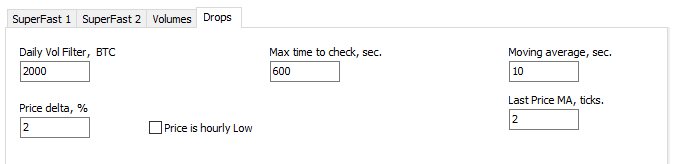

The Fourth method “Drops” – new in version 2.80.

Turned on by default.

Daily Vol Filter: Initial daily volume is greater then specified value in BTC. Helps to filter out low-volume altcoins.

Max time to check, sec.: Period to analyze.

Moving Average, sec: Interval to calculate Moving Average. The bot is getting 2-seconds price ticks, so for example If you set this to 10 seconds, then each 5 prices will be averaged. The bot then takes maximum avarage price and compares it to the last price.

Last Price MA, ticks: Ticks to calculate last price average value. If you set this to 1, then the last price will be taken as is. The more this value the less detection sensitivity for fast drops.

Price delta: Price drop during analysis period, percentage.

Price is hourly high: Current price at the moment of detection is hourly lowest.

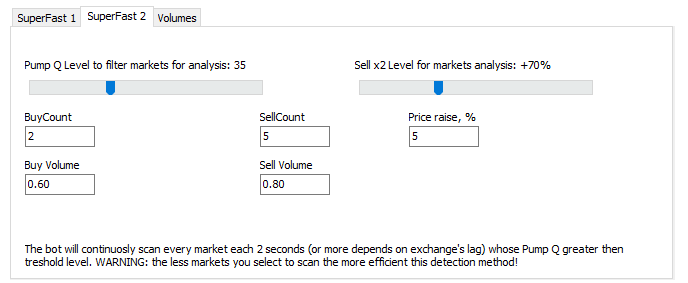

Settings -> SuperFast2 options meaning:

Pump Q Level: The “pump quality” value of the coin, below which coins are not taken into account in the analysis. (i.e. Bot looks only at those coins for which Pump Q is greater than given). The more coins to check – the less efficient this method will work.

Sell x2 Level: Height of the sell orders book wall as a percentage of the current price. Total sell volume from the current price to the specified price is used to estimate the “Pump Quality” of the coin. For example, if 90% is given, then Bot calculates how many bitcoins need to be poured into the coin, so that its price grows 1.9 times. This parameter is selected experimentally, depending on the particular pumping channel in which the pump is expected, on the general market situation and desired profit from the pump. The default value is 100%.

Other parameters have a brief description inside the bot, hover your cursor over a value to see what does it mean.