STOPLOSS CONFIGURATIONS AND PENDING ORDERS

Pending orders help to implement a trading strategy on breakdowns, as well as set stop loss and trailing stop more accurately.

Trading order types

A) real order sitting in the order book:

Buy — regular Limit buy order. After execution turns into a sell order.

Short — a limit order that will open a sell position on the futures market. After execution turns into a buy order meant to close the position.

Sell — a regular Limit sell order.

B) Pending order — an order placed pending a condition.

Is placed on the exchange after the fulfilment of a certain condition and turns into a Buy order. Pending orders are of two types: buy limit and buy stop. To be used for trading on breakthroughs. After execution turns into a Sell order. Allows you to set the Sell price in advance after the Buy order is executed and set the stops.

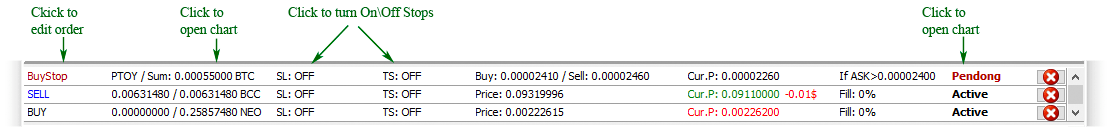

Window with active orders: each order contains order’s type, price, stops On\Off and other parameters. To remove pending order, click “X” button to the right. To show market chart for the coin in an order click “Active” or “Pending” caption. To edit an order click on its type caption.

Creating and editing orders

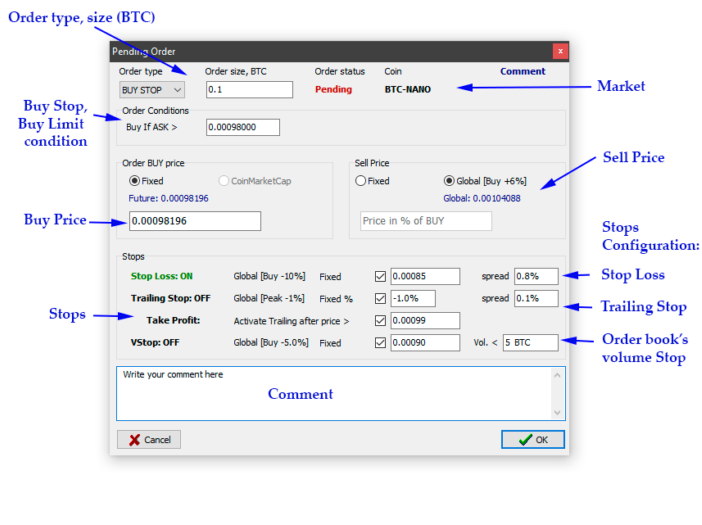

To create new order click the button “Order” to the right of the market chart. To edit an existing order click on its type caption. For example, to edit the NANO Buy Stop pending order from the picture above click on the “BuyStop” caption:

Order Type: Once created, can not be modified.

Buy Stop condition: Buy Stop order will be executed when current market ASK price will reach specified price. (current ASK > specified ASK).

Order Price: The Limit order price. For a Buy Stop pending order you may want to set higher price then the buy stop conditional price, otherwise your order most likely won’t be executed. If you edit the order price for an active order. the order will be replaced for a new price.

Sell price: After a buy order is executed, all bought altcoins will be sold at specified price. You can set either global or fixed price. Global is main window’s [actual buy +X%] sell price, fixed is the absolute value.

Pending orders can also be set by mouse click on market chart (configure click kind in the “Settings – UI” tab). In this case conditional price is the price at mouse cursor, actual limit price when pending order is excecuted determinated by spread for pending orders (configure in the “Settings – UI”). If the spread is positive, the limit order will be set at higher price than conditional, otherwise at lower price.

Stops Configuration

You can turn on\off the Stop Loss for each order independently of the bot’s global stops settings. If you don’t specify fixed levels then global settings for the levels will be used. If you specify fixed stop loss price and current market BID fell to this price, the bot activates Panic Sell which can further drop your sell order to the spread value (0%..2%, configure in the main settings). The bot will not drop price any lower! For example, in the picture above there is stop loss price 0.00085, Panic Sell Spread is 0.8%. In this case if the NANO BID price fell below or equal to 0.00085, the bot will try to sell NANO for the best possible price from 0.00085 to 0.0008432.

Pay attention: If you are manually moving the stop line, a fix is placed in the order. The stop level at the price you’ve just moved the line to.As a result, when the stop line is crossed and the Panic Sell is activated, the order will be moved to the level of the stop minus the spread, but not lower than that! And if it is not executed and the price goes lower, the order will remain on that level because the AllowedDrop in this case is equal to the stop level.

Trailing stop: You can use either global or fixed for this particular order. If you specify the Take Profit price (“Activate after price > X” checkbox), then the bot will activate trailing only after the specified Take Profit plus trailing persent is reached. This means that event after price drops from high to trailing persent, it must still be higher than Take Profit value.

For example, in the NANO order above Take Profit is 0.00099, trailing persent is 1%. This means that trailing can be activated only after 0.0010 so that from this moment If price drops to 1% (0.0010 – 1% = 0.00099) it is still higher than Take Profit.

If the price has raised for example to 0.002 and dropped after, trailing will be activated and will try to sell your order for the best possible price from 0.0012 to 0.00099.

VStop (Volume Stop): When the volume in the BIDs order book at the specified price drops to specified value, Stop Loss will be activated. You can specify price either higher or lower then your buy price. Note that If you use higher price, you must first wait until BIDs order book is filled upto your price before you turn on VStop. (Turned OFF by default for every new order).

Important

Pending orders will be executed only If you push the Start button in the main window.After you push the Start button, every pending order which conditions are met will be executed even If those conditions was met long ago!