BTCUSD Quarterly Futures Contracts on Binance Futures

The ability to trade Quarterly BTCUSD Future Contracts on Binance Futures was added to MoonBot. More details about this here.

Quarterly futures were added to MoonBot as a separate Exchange (Place the bot into a separate folder. Go to settings — login and chose Binance Quarterly. Click Apply. Insert the API key. The regular futures trading keys are valid for this operation but you can create new ones on the exchange as well, just make sure they allow futures trading).

Important:

1. Base currency — BTC (not USDT). Imagine the pair BTC-USD, min lot = 100$. Orders are counted in lots. Thus, opening a long position, you are buying Bitcoins for Bitcoins; the long with leverage equal to one still has a liquidation price. When opening such a long, the Exchange will claim a collateral in BTC at the current market price, for this reason, opening such a long position does not equate to just holding BTC. This is the hardest part to understand, the rest are just technicalities.

2. Related to the above point, the volumes are calculated as follows: the volume in the order book and the volume of trades are counted in lots, the bot converts that to USD. The volume of orders are shown in lots, like on the exchange; the Balance is shown in BTC, the order size is also set in BTC.

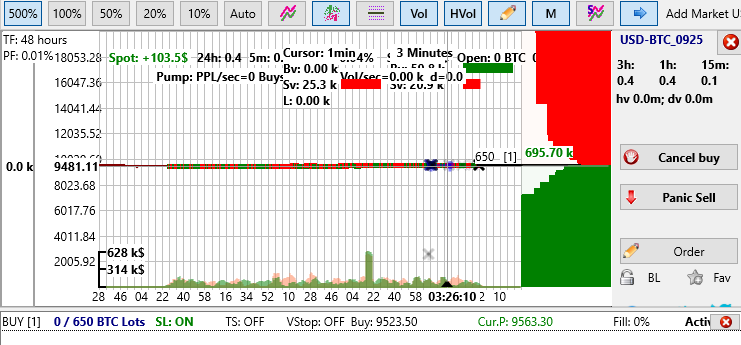

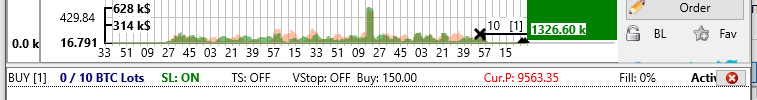

Unlike the USD futures (and spot), the lower the price, the lower the size of the order you can place. For example, the screenshots below show that when placing an “all-in” order down instead of having 650 lots, you end up with 10 lots:

This is not a bug, rather a consequence of balance mathematics in BTC (the lower the price, the more bitcoins you must pay as collateral for the order).