Education

Here you will find all the knowledge and tools for confident trading in the

Moonbot terminal:

from understanding terms and strategies — to trade analysis and risk control.

The principle of limiting losses and preserving capital

Profit is unpredictable, but loss can be limited. The goal of risk management is to define in advance the maximum acceptable loss per trade and over the trading period in order to preserve funds in the trading account and ensure stable results.

Note:

important note on terminology: In the context of risk management, the terms "capital" and "deposit" are used interchangeably and refer to the amount of funds in your trading account. For consistency throughout this section, we will use the term "deposit" in all calculations and examples.

The implementation of the principle of limiting losses and preserving the deposit in practice is based on the following basic rules.

Basic Cryptotrading Rules

-

Limit risk per trade to a fixed percentage of your deposit (typically 0.5–2%)

-

Set a daily/weekly loss limit (e.g., 2–6% per day)

-

Always use a Stop Loss for each position

-

Plan for a profit-to-risk ratio of at least 2:1 before entering a trade

-

Do not average down losing positions unless explicitly defined in the trading plan

-

Keep a portion of your deposit in reserve for slippage and fees

-

Log trades and drawdowns, track reasons for losses

-

Take a break if the daily or weekly loss limit is reached.

Example of calculating a daily limit and per-trade limit

Let’s look at how risk limits work in real trading scenarios.

Initial data:

-

Deposit: 1,000 USDT

-

Risk per trade: 1% (10 USDT)

-

Daily loss limit: 6% (60 USDT)

Note: PnL (Profit and Loss) is the total financial result of all trades. Accumulated PnL reflects the financial outcome over a selected trading period. In the context of daily limits, the trading day usually refers to a calendar day based on the exchange time or the time zone specified in the terminal settings.

Scenario 1: A Series of Losing Trades Within Risk Limits

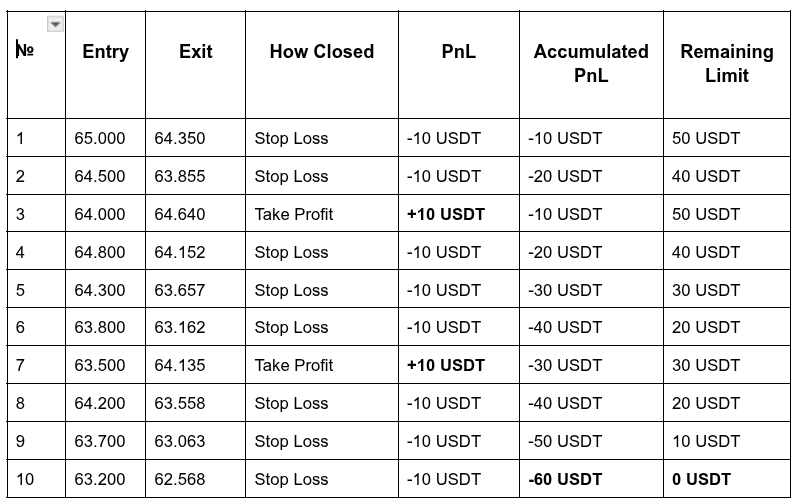

The trader opens a series of trades during one trading day, as defined by the exchange or terminal settings. Most trades result in losses, but two are profitable (see Table 1).

Table 1

Result: After the 10th trade, the daily loss limit of 60 USDT (6% of the deposit) is reached. Trading stops for the day, even though capital remains. Out of 10 trades, 2 were profitable and 8 were losing. The deposit is preserved at 940 USDT — exactly a 6% drawdown, no more.

Scenario 2: Slippage and Exceeding the Per-Trade Risk Limit

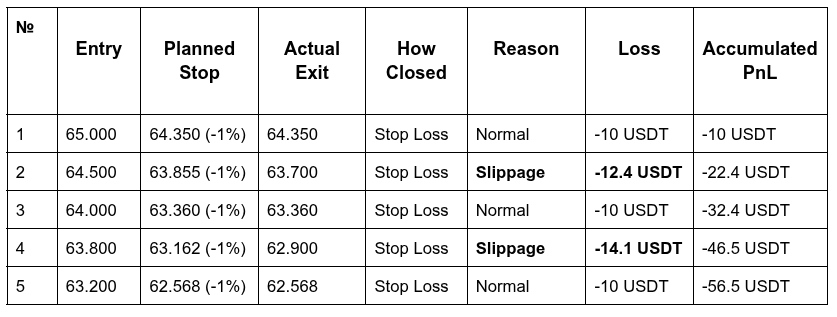

The trader opens positions in a volatile market. Some stop-losses are triggered with slippage (see Table 2).

Table 2

Result: After the 5th trade, the accumulated loss reached 56.5 USDT — nearly hitting the daily risk limit of 60 USDT. Trading is halted.

Note: Due to slippage in trades №2 and №4, actual losses exceeded the planned 1% per trade (12.4 USDT and 14.1 USDT instead of 10 USDT).

Conclusion: This is why a daily risk limit is critical — it protects the deposit from compounding losses when market conditions (volatility, low liquidity) cause slippage and breaching of per-trade limits. Without a daily cap, the trader could have continued and lost significantly more.

📊 Risk Management Calculator

To perform your own risk calculations, use the Excel file "Trade Calculator with Limits". Inside, you can:

-

Set your deposit, per-trade risk limit (default: 2%), and daily loss limit (default: 14%)

-

Enter entry and exit prices for each trade

-

Automatically track: profit/loss, number of trades, remaining daily limit, total PnL, and current deposit size.

To structure this approach and apply it before every trade, use the checklist below.

Checklist: Preparing for a Trade with Loss Control

-

1. Determine the risk amount per trade (as a percentage of your current deposit).

-

2. Identify a technically justified stop-loss level before opening the position (for example, beyond the nearest support/resistance, local low/high, or pattern boundary).

-

3. Evaluate the expected profit-to-risk ratio (≥ 2:1); if it doesn’t meet the requirement — skip the trade.

-

4. Calculate position size based on the risk amount and stop-loss distance (covered in detail in the next section of 6.2).

-

5. Place protective orders immediately after entry (stop-loss, and if needed — take-profit/bracket).

-

6. Set a daily loss limit; if it’s reached — stop trading until the next trading day.

Common Risk Calculation Mistakes

On the path to disciplined trading, many traders face similar challenges. Below are the most frequent ones:

-

Trading without a stop-loss

-

FOMO (Fear Of Missing Out) — impulsive trades due to fear of missing a price move. The trader enters the market without a strategy signal, just because "everyone is buying" or "the price is already moving". Result: entry at the top and loss.

-

Rule: only trade based on your signals — not out of fear of missing out.

-

Increasing risk after a series of losses

-

Ignoring daily limits and trying to "win back" losses

-

Changing the trade plan mid-position without valid reasons

-

Failing to account for fees and slippage.

This principle is fundamental: protect the deposit first — grow it second. In the next subsections, we’ll cover position sizing, leverage, and exit mechanisms.